Page 293 - ICSE Math 8

P. 293

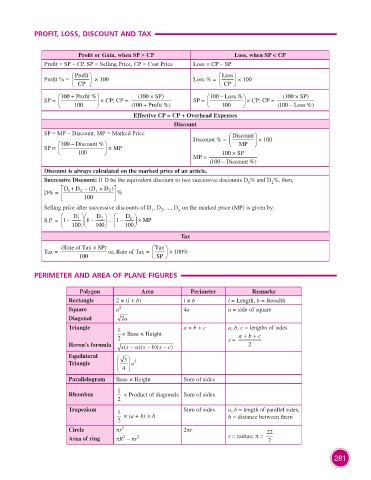

PROFIT, LOSS, DISCOUNT AND TAX

Profit or Gain, when SP > CP Loss, when SP < CP

Profit = SP – CP, SP = Selling Price, CP = Cost Price Loss = CP – SP

Profit Loss

Profit % = × 100 Loss % = × 100

CP CP

100 + Profit % (100 × SP) 100 – Loss % (100 × SP)

SP = × CP; CP = SP = × CP; CP =

100 (100 + Profit %) 100 (100 – Loss %)

Effective CP = CP + Overhead Expenses

Discount

SP = MP – Discount, MP = Marked Price Discount

Discount % = × 100

100 – Discount % MP

SP = × MP

100 100 × SP

MP =

(100 – Discount %)

Discount is always calculated on the marked price of an article.

Successive Discount: If D be the equivalent discount to two successive discounts D % and D %, then,

1

2

D + D – (D × D )

D% = 1 2 100 1 2 %

Selling price after successive discounts of D , D , ..., D on the marked price (MP) is given by:

n

2

1

D 1 D 2 D n

S.P. = 1 − 1 − … 1 − × MP

100 100 100

Tax

(Rate of Tax × SP) Tax

Tax = or, Rate of Tax = × 100%

100 SP

PERIMETER AND AREA OF PLANE FIGURES

Polygon Area Perimeter Remarks

Rectangle 2 × (l + b) l × b l = Length, b = Breadth

Square a 2 4a a = side of square

Diagonal 2a

Triangle 1 a + b + c a, b, c = lengths of sides

2 × Base × Height s = a + b + c

Heron’s formula ( ss − a )(s − b )(s − ) c 2

Equilateral 3

Triangle a 2

4

Parallelogram Base × Height Sum of sides

1

Rhombus × Product of diagonals Sum of sides

2

Trapezium 1 Sum of sides a, b = length of parallel sides,

2 × (a + b) × h h = distance between them

Circle pr 2 2pr 22

2

Area of ring pR – pr 2 r = radius; p = 7

281